Now the iPhone and its suppliers are facing challenges that would be familiar to the PC companies a decade or so ago. Though the iPhone X is expected to sell some 32 million units over the holidays, according to an estimate by Arthur Liao at Fubon Securities, the once-hip handset is becoming a mature product.

Demand is slowing and it is facing stiff competition from lower-priced Chinese smartphones. Apple's suppliers are beginning to talk about when the smartphone itself will join the long list of technology's disrupted.

"Industries will change. We won't stay in the smartphone age forever," Tung Tzu-hsien, chairman of contract manufacturer Pegatron, told reporters in December. "The smartphone has enjoyed a boom for over 10 years. Many people ask me whether it will decline like notebooks."

Tung said he has not seen anything that would threaten smartphone demand, but noted that the so-called internet of things will create "many niche markets" such as sensors for medical care.

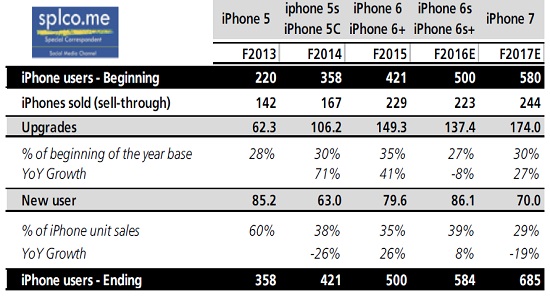

According to research company IDC, the smartphone market will see a 3.3% compound annual growth rate from 2016 to 2021, compared to 10.4% in 2015. Annual iPhone shipments grew 2.3% in the past fiscal year ended in September. Last year, Apple sold 215.4 million iPhones, capturing 14.5% of the global market, trailing Samsung Electronics' 309.4 million smartphone sales, according to research company Strategy Analytics.

"The overall smartphone market is quickly maturing. We are looking at some only 3% to 4% of growth each year now -- still growing, but we no longer have dramatic growth like past years," said Sean Kao, an analyst at IDC.

Few remember that when the iPhone first hit the market, Apple had to slash the price tag by $200 to $399 to win over skeptical consumers. But the U.S. tech company's sales eventually grew more than nine times, reaching $229.23 billion in 2017. Its market value, at around $895 billion, has led market watchers to wonder whether it will become the first $1 trillion company.

Major iPhone suppliers saw their revenues boom, too, amid a transformation of Asia's tech supply chain. "Over the years, Apple has been raising the average selling price of iPhones, whose functionality has also been improving as time goes by. If given the same margins, their suppliers' profits naturally would increase," said Vincent Chen, an analyst at Taipei-based Yuanta Investment Consulting.