On the very first day of a country-wide rollout, the government on Thursday deferred the electronic-way (e-way) bill indefinitely, as consignments faced delays. According to industry executives, businesses faced disruptions after the portal stopped functioning from around noon, causing widespread confusion and hassle.

Companies were seen flooding the National Informatics Centre (NIC), which is developing the e-way portal, with complaints as they grappled with systems-related issues over the past couple of days. “In view of difficulties faced by the trade in generating e-way bill due to initial tech glitches, it has been decided to extend the trial phase for the generation of e-way bill, both for inter and intra-state movement of goods. It shall be made compulsory from a date to be announced,” GST@GoI, the official government handle, posted on Thursday evening.

NIC is learnt to have asked the finance ministry for 15 days’ time to address the problems. E-way bills will help the central and state tax authorities track inter-state and intra-state movements of goods that are part of consignments of Rs 500 billion or more.

A few companies stopped consignments as they failed to comply with the e-way bill requirement.

Many others were seen calling and writing to their jurisdictional commissioners over the glitches on the portal.

While the e-way bill system is being developed by NIC, other IT matters related to the GST are being managed by the GST Network (GSTN), a private body. An advance of Rs 400 million has been given to NIC to implement the e-way bill mechanism.

“This is precisely what the industry was concerned about. It is good that the government has been quick to defer it,” said Pratik Jain, partner, PwC India. Hopefully, the trial period will also provide the government an opportunity to test the system and fix the technical glitches, Jain added.

"The e-way bill’s introduction should be mandated only when the portal is completely tested. This is all the more necessary as several states have made it compulsory even for intra-state movements and any disruption would be difficult for businesses to handle," M S Mani, Partner, Deloitte India.

The inconsistent intra-state rollout across the country is another issue faced by companies. While all states were to introduce e-way bill system for inter-state movement of goods from Thursday, 13 states had also mandated it for movement of goods within the state (intra-state).

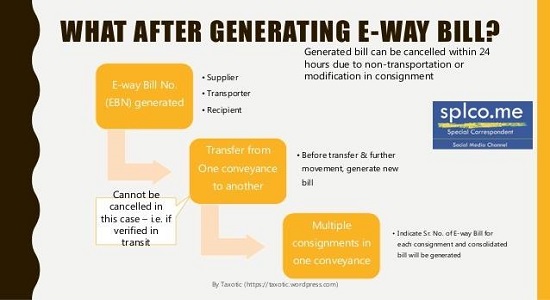

A tax commissioner or an officer empowered by him or her will be authorised to intercept any conveyance to verify the e-way bill or the number in physical the form for all supplies.

The revenue slowdown prompted the GST Council to call an urgent meeting on December 16 and advance the roll-out of the bill on the inter-state movement of goods on February 1 and for intra-state carriage on June 1.