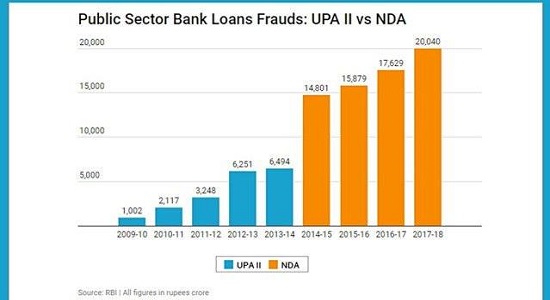

In response to an RTI application filed by economist and activist Prasenjit Bose, the Reserve Bank of India has now confirmed that in the last four years of the Modi Government, loan frauds have amounted to a whopping ₹55,000 crore more than in the previous five years of UPA-II under former Prime Minister Manmohan Singh.

Expressing his shock and dismay, Bose said, “Where are the investigating agencies? How many fraudsters have been arrested and prosecuted for their crimes?

The Union Finance Ministry must be held accountable for this massive loot of money from the banks and undermining the public sector banking system.”

Not only have the number of fraud cases increased under the present regime, the amount involved in loan frauds have also grown more strikingly; it has in fact trebled. This points towards systemic corruption in sanctioning loans to large borrowers.

The reply from the RBI, he maintains, highlights the following:

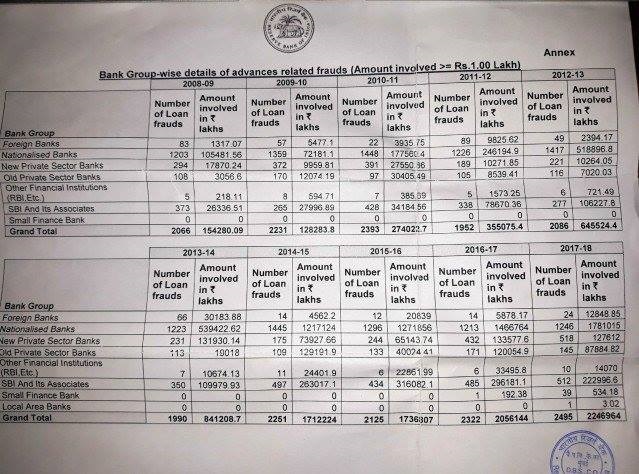

The PSBs account for 88% of the amount involved in Loan frauds.

There were 9,193 cases of loans frauds across Nationalised, ie Public Sector Banks, Foreign Banks, Private Sector Banks, other Financial institutions and small finance banks and local area banks in the last four years (April 2014 to March 2018), involving an amount of ₹77,521 crore.

In the previous five years (April 2009 to March 2014) there were 10,652 cases involving ₹22,441 crore.

Instances of loans frauds in Public Sector Banks have totalled 7,128 in the last four years, with an amount of ₹68,350 crore involved.

In the previous five years there were 8,331 cases involving ₹19,113 crore.

Loan frauds at Private Sector Banks total 1,927 involving ₹7,774 crore in the last four years.

In the previous five years there were 2,005 cases involving ₹2,670 crore.

Can RBI install checking mechanism for NPA for this rapid rise of loan frauds asks Economic Experts.