Angadiyas —Hindi for couriers— are the cogs in the parallel banking network of black money or slush funds that cannot flow through the legitimate banking system but travel through these agents. When black money is transacted overseas the conduits are called hawala agents.

“The money never changes hands,” explains, Ravi, a Delhi-based client of the Chawri Bazar shopkeeper who agreed to be identified by just one name. The shopkeeper spoke to media on condition of anonymity to avoid attention from police.

“Suppose I get an order to sell 1,000 bottles of glue at 200. of a total 2 lakhs Rupees but I will invoice it at the rate of 100 only for a total of 1 Lakhs rupees in my books and that will be transferred to my bank by my client,” said Ravi, who supplies industrial glue to businessmen in Ludhiana.

“But the remaining 1-lakh will come to me through the chain of angadiyas between Delhi and Ludhiana.” There is no physical movement of cash, only phone calls or messages from one angadiya to another.

The Chawri Bazar man just has to ensure that he has enough cash to make the final delivery to Ravi. In return, he earns a commission. In this case, the Chawri Bazar man is the terminal point in the chain.

In other cases, he could be the first point with his Ludhiana counterpart being the terminal one. At some point, the angadiyas square off their books.

November 8, 2016 is a date the Chawri Bazar shopkeeper won’t forget in a hurry. The entire amount with the Chawri Bazar man was in Rs 1,000 notes—all of it unaccountable to taxmen. Hundreds of his fellow angadiyas also saw huge amounts of money vanish into thin air that evening.

But a year later, the wily network of black money agents is slowly recovering from that body blow as demand for their services grows from shadowy businesses operating on the margins of the legal economy.

Curiously, the Chawri Bazar storekeeper is not sore about demonetisation, which priced out smaller angadiyas.“It has reduced competition,” said the 39-year-old angadiya, rocking back his lean frame in a couch at a central Delhi coffee shop he picked to meet with the Hindustan Times (HT) journalists.

Demonetisation changed other things, too. Code words now change more frequently, as do mobile numbers.

“WhatsApp is the safest,” said a South Delhi hawala agent known as Bhai-ji. The 47-year-old stocky man fiddled with his three high-end mobile phones as he allowed HT glimpses of his secretive communication codes: Kg for $10,000; two-kg for $20,000.

For the angadiyas that survived demonetisation, increased risk fetches higher commissions from 0.8% to 1.3% ie., 80-100 to 130 for each lakh of rupees transferred on the Ludhiana - Delhi network. It can go higher if the deadline is tighter and the facilitator cleverer.

Hawala agents like Bhai-ji now charge 20-50 paise per US dollar as commission. Though the mark-up depends on the amount and destination, it is much higher than the pre-demonetisation rates of 15-25 paise per dollar.

The government has banned cash transactions over. 2 lakh since April; if caught an equal amount must be paid as penalty.

Official data shows a 154% increase in tax raids under Modi in 2016-17 leading to a 272% increase in black money recovery. So more black money after demonetisation.

“There is no evidence to suggest that black money generation has reduced, but increased surveillance and curbs on cash transactions has made the business of cash transfers within and outside the country risky,” said a top tax officer.

Back in Chawri Bazar, the young angadiya agreed the focus on digital economy is hurting him. To meet money transfer demands, at times he borrows from local money lenders.

“Imagine, they charge interest on hourly basis,” he complained.

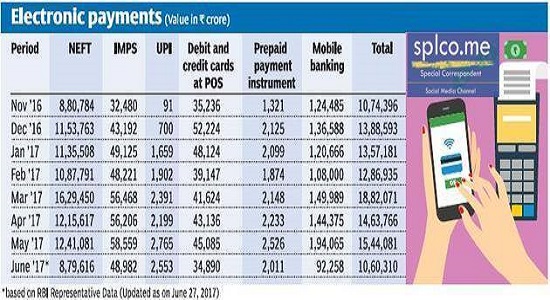

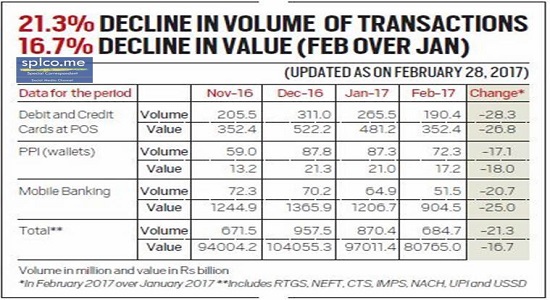

The RBI data however reveals digital transactions dropped.

But he also saw a silver lining. “The increased rates will help once the economy picks up and we have more demand for money transfers.”

Source : Input Syndicate feeds thanks HT.