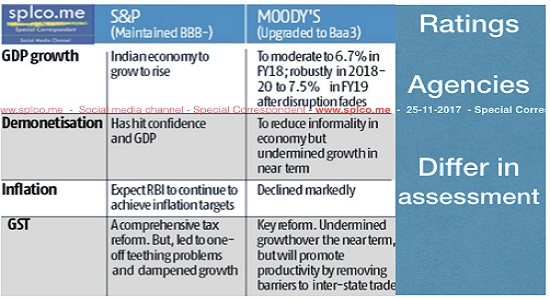

Standard & Poor’s (S&P) Global Ratings has kept India’s sovereign rating unchanged at ‘BBB-‘ with stable outlook, citing vulnerabilities stemming from low per capita income and high government debt.

S&P’s rating remains at BBB-, one notch above junk and a notch below what Moody’s Investors Service upgraded India to recently.

Whereas Moody’s Investors Service had last week upgraded India’s sovereign credit rating after 13 long years, expecting continued progress on economic and institutional reforms to boost the country’s growth potential. It lifted India’s rating to Baa2 from Baa3 and changed its rating outlook to stable from positive, saying that risks to India’s credit profile were broadly balanced.

S&P said, according to media reports, “Stable outlook reflects our view that over the next two years growth will remain strong, India will maintain its sound external accounts position and fiscal deficits will remain broadly in line with our expectation.”

It said, “upward pressure on the ratings could build if the government’s reforms markedly improve its net general government fiscal out-turns and so reduce the level of net general government debt. Upward pressure could also build if India’s external accounts strengthen significantly.”

At the same time, however, it warned that downward pressure on the ratings could emerge if “GDP growth disappoints, net general government deficits rose significantly; or if the political will to maintain India’s reform agenda significantly lost momentum.”

In January 2007, S&P had rated India at BBB-, the lowest investment grade rating for bonds, and gave an outlook of ‘stable’.

It changed the outlook to negative in 2009 and raised it to stable in 2010. In 2012, the outlook was again lowered to negative, which was raised to stable soon after the Narendra Modi government assumed office in 2014.

S&P had in October 2017 said India needed to improve its fiscal position for a rating upgrade. It kept India’s sovereign rating unchanged at the lowest investment grade with a stable outlook.

India has one of the highest general government debt to GDP levels (68 percent) among emerging market sovereigns which have an average of 44 percent government debt to GDP ratio.

A report by another rating agency Fitch Ratings is now awaited.