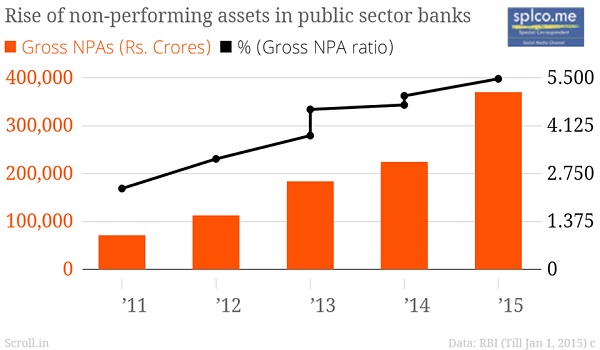

While banks remain the main source of funding for India’s companies, the stubborn increasing bad debt problem has eaten into bank profits and choked off new lending, at a time when an economy that depends on them is stalling.

21 one state-run banks account for more than two-thirds of India’s banking assets. But they also account for a bulk of the record Rs 9.5 trillion ($145 billion) of soured loans.

In addition to repairing their balance sheets, the banks also need billions of dollars in new capital to meet global Basel III banking rules, due to kick in by March 2019.

Fitch Ratings estimates Indian banks will need $65 billion of additional capital by March 2019 to meet Basel III global banking rules. Moody’s expects the top 11 state lenders alone will need nearly $15 billion.

Following this Modi government approved on Tuesday a state bank recapitalisation plan of Rs 2.11 trillion rupees ($32.43 billion) ie., 211000 Crores over the next two years, in a bid to clean banks’ books and revive investment in a slowing economy. The government has just $3 billion left in its budget for bank recapitalisation.

Of the planned sum, recapitalisation bonds will account for Rs 1.35 trillion, while Rs 760 billion will come from budgetary support and equity issuance, said Rajiv Kumar, financial services secretary.

Finance minister Arun Jaitley said the recapitalisation of state banks would be followed by a series of reforms. However he refused to divulge to give details.