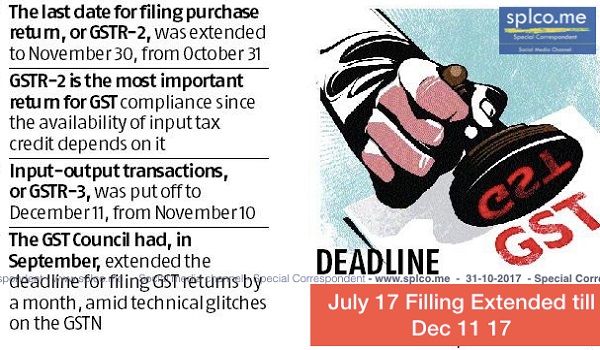

The last date for filing purchases and input-output transactions for July, or GSTR-2, was extended to November 30, from October 31. That of input-output transactions, or GSTR-3, was put off to December 11, from November 10.

“To facilitate trade, the last date for filing GSTR-2 and GSTR-3 for July 2017 has been extended to November 30 and December 11, respectively,” a government tweet said.

Archit Gupta, chief executive officer, ClearTax, said, “The earlier last date for filing GSTR-2 coincided with the deadline for submission of audited income tax returns and as such was putting a strain on some taxpayers.”

Earlier The GST Council had, in its meeting in September, extended the deadline for filing GST returns by a month, amid technical glitches faced by assesses on the GST Network (GSTN) portal. The extension of deadline will give more time to taxpayers to file input tax credits, take remedial action for mismatches, and enable accurate filing.

The Council constituted a group of ministers (GoM) led by Bihar Deputy Chief Minister Sushil Modi to look into taxpayers’ concerns with respect to return filing on the GSTN portal.

The decision to extend the deadline comes after the GoM on GSTN met on October 28 in Bengaluru to review the issues faced during GSTN filings. Tejas Goenka of Tally Solutions said this is the first time everyone is dealing with the invoice matching process.

“This is not going to be easy. It is important to get started on this early despite the extension,” he said.

In the coming days, the big challenge for the GST Council and the GoM will be to review the invoice matching functionality of the GST. Infosys has already fixed some bugs, based on feedback from states. The GSTN vendor and software major had won the Rs 1,380-crore contract to implement the GSTN and maintain it for five years in September 2015.